Bearish for NVDA, Bullish for Airports

Lukasz Tomicki joins Caroline Woods of Schwab Network to discuss his thesis on the AI sector, his thoughts on NVIDIA, and his bullish case for investing in foreign airports.

Nvidia (NVDA), A.I. Selloff “is Just Getting Started”

Lukasz Tomicki joins Oliver Renick on Schwab Network to discuss his bearish case for AI, his outlook on big companies such as Apple potentially being less vulnerable than other companies with AI exposure, and an international oil stock he likes (Petrobras).

5 market experts break down why no emergency Fed rate cut is coming

“I believe the current sell-off has its origins in the unwinding of the Japanese Yen carry trade and it should not influence the Fed’s decision.”

Lukasz Tomicki discusses with William Edwards of Business Insider why he doesn’t believe the Fed will make an emergency rate cut.

Reasons to Short Nvidia (NVDA)

Lukasz Tomicki joins Oliver Renick of Schwab Network to discuss his views on AI, and a couple insurance names, RLI Insurance Company and W. R. Berkley Corporation Berkley.

GLP-1 Concerns Clobbered This Healthcare Stock. It’s Time to Buy.

Lukasz Tomicki discusses ResMed and its outlook with Jacob Sonenshine of Barron’s.

A hedge fund manager beating the S&P 500 through April warns stocks could ‘easily’ drop 20-30%

Lukasz Tomicki joins William Edwards of Business Insider to discuss his thoughts on where the market could be headed, as well as five economically resilient companies he’s betting on.

FNV, PBR, OMAB: Finding Small Cap Opportunities Abroad

Lukasz Tomicki joins Oliver Renick on Schwab Network to discuss a couple stocks to play inflation and ongoing deficits.

More defensive names are the place to be: analyst

Lukasz Tomicki joins BNN Bloomberg to discuss defensive names and what he thinks could do well in case of an economic slowdown.

If bond yields and oil prices keep rising, the market rally could be derailed: analyst

Lukasz Tomicki says continued rising bond yields and oil prices could derail the market rally, as he joins BNN Bloomberg’s Amber Kanwar to discuss his latest thoughts on the markets and how he positions his strategy to outperform.

Bloomberg Intelligence Radio Interview

Lukasz Tomicki joins Alix Steel and Paul Sweeney on Bloomberg News Radio to discuss how he looks at the markets, what he looks for in a high-quality business, and how he builds his strategy.

(Interview starts at 40:27)

How Long Will A.I. Euphoria Last?

“That’s where we are as equity investors. We are in the ‘upside down’, and what I mean by this is paradoxically, equities have become less risky than bonds…”

Lukasz Tomicki joins Oliver Renick and Schwab Network to discuss investing in a ‘no landing’ economy, his market outlook, and a couple companies, including Masimo and MarketAxess.

We are clearly in the ‘max stupid’ levels of the market: analyst

“We are at ‘max stupid’ levels in the market.”

Lukasz Tomicki discusses the state of the market with BNN Bloomberg’s Andrew Bell.

Finding Investment Opportunities Outside of Nvidia (NVDA)

Lukasz Tomicki joins Oliver Renick and Schwab Network to discuss his view on markets, the energy sector, and reviews his thoughts on Charter Communications and InMode.

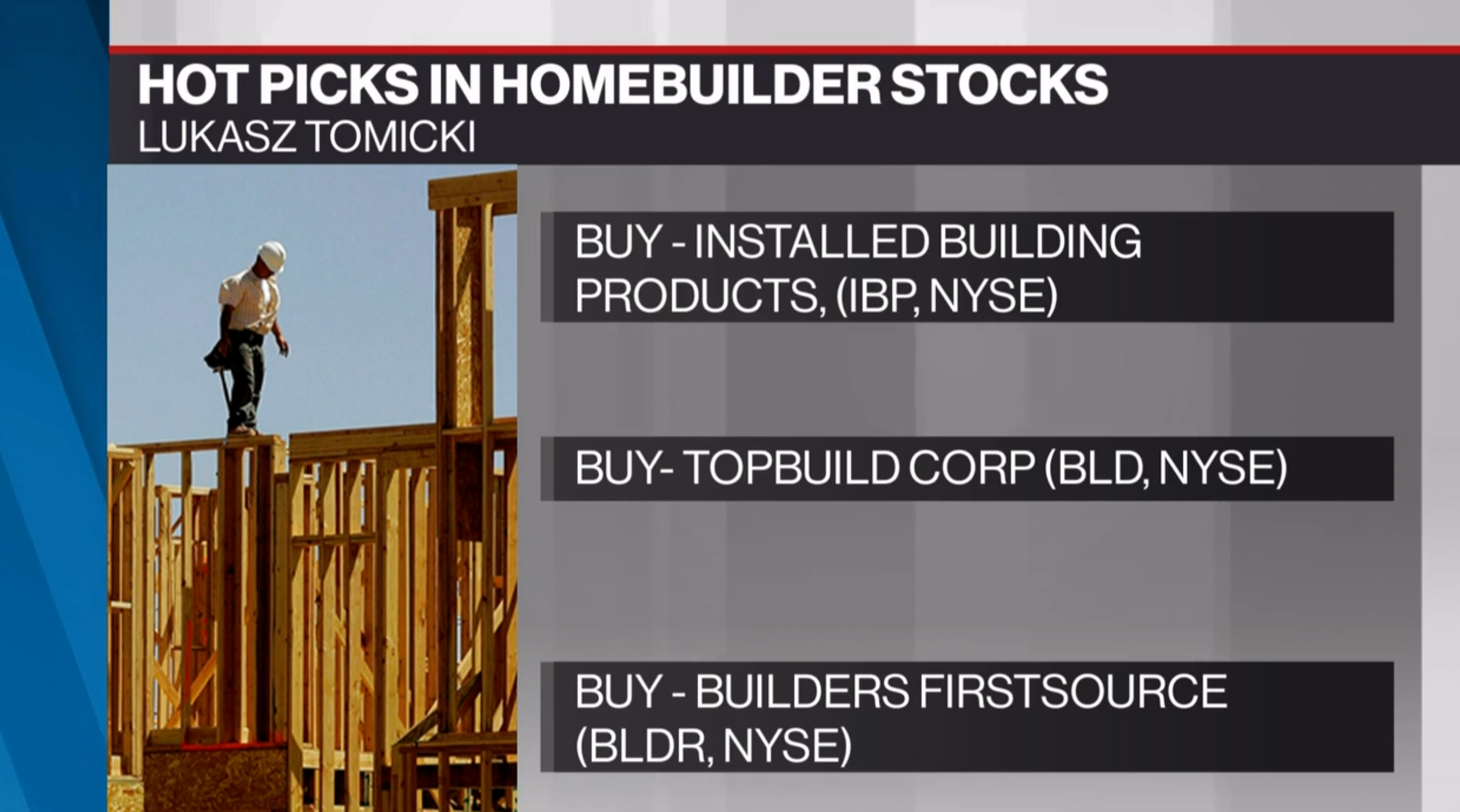

Hot Picks: Three plays in an outperforming sector

Lukasz Tomicki discusses the state of the housing sector with BNN Bloomberg and says that as long as housing demand stays strong, homebuilders can continue to grow revenues and profits.

“Am I saying the market is going to fall 40%? Not necessarily, but you can play with the numbers. It’s very hard to come up with a scenario where there’s a good, strong positive return for the market, unless you think we’re going into some kind of complete mania like we had in 2021 or 1999.”

Lukasz Tomicki warns the S&P 500 is priced for perfection, with William Edwards of Business Insider.

Fed wants to cut rates, despite what Powell said: Strategist

Lukasz Tomicki discusses his reaction to the Fed announcement with Yahoo Finance’s Julie Hyman and Josh Lipton, and why he thinks rates might get cut sooner than later.

The market has priced in very high expectations: analyst

Lukasz Tomicki joins BNN Bloomberg‘s Amber Kanwar to discuss his market outlook for 2024, differences between the state of today’s market vs. previous years, and where he’s looking for value.

Lukasz Tomicki joins Oliver Renick on Schwab Network to discuss his view on the markets, and three of his favorite value picks as 2024 gets underway.

The Estée Lauder Companies Inc., Dollar General, Franco-Nevada Corporation

Lukasz Tomicki of LRT Capital Management talks stocks in the Market Call

Lukasz Tomicki joins Money Life with Chuck Jaffe to discuss his investment philosophy and stocks to consider heading into the new year. Tune in to hear his thoughts on several names!

Lukasz Tomicki joins Paul Sweeney and Simone Foxman on Bloomberg News Radio, to discuss some stock picks and other ideas as we head into 2024.

Now is a good time to choose lower volatility hedged strategies: portfolio manager

Lukasz Tomicki says investors should seek low volatility hedged strategies heading into 2024 and discusses where they should look for opportunities, including The Estée Lauder Companies Inc., with andrew bell and BNN Bloomberg.

Hot Picks: Three reasons why you should not throw in the towel on lithium stocks

Lukasz Tomicki joins BNN Bloomberg‘s Hot Picks Segment to discuss the lithium sector, including Albemarle Corporation, Livent, and SQM.

Cell-Tower REITs Are Beckoning Investors. Pick Up the Call.

Lukasz Tomicki discusses cell tower REIT’s, including Crown Castle, with Nicholas Jasinski of Barron’s.

PYPL, WSM, ABG: Stock Investors Should Watch

Lukasz Tomicki joins Oliver Renick on Schwab Network to discuss some of his favorite names, including PayPal, Williams-Sonoma, Inc., and Asbury Automotive Group.

Hot Picks: Three uniquely positioned refiner stocks

Lukasz Tomicki joins BNN Bloomberg‘s Paul Bagnell to discuss the oil refining space and his picks in the sector, Marathon Petroleum Corporation, HF Sinclair, and Valero.

Yields, Caterpillar, Euro, and the Fed

Lukasz Tomicki joins Paul Sweeney and Matthew Miller of Bloomberg News to discuss investing in resilient companies ahead of a potential recession. Lukasz names Chemed Corporation, Elevance Health, and TriNet as picks to consider!

Lukasz’s segment starts at 35:30 and ends at 43:00.

Lukasz Tomicki discussing his investment philosophy and three of his favorite names right now, RLI Insurance Company, Northrop Grumman, and EMCOR Group, Inc. with William Edwards of Business Insider.

CCI, SUI, NOC: Strong Stocks & DIS A Dying Cash Cow?

Lukasz Tomicki joins Oliver Renick and Schwab Network to discuss Northrop Grumman, Crown Castle, and Sun Communities & Sun Outdoors, while also laying out his case against The Walt Disney Company.

Speaking at UT Austin

Yesterday, I had the opportunity to speak to Professor Clemens Sialm MBA Fund class at Texas McCombs School of Business at The University of Texas at Austin. We discussed general investing topics, how to think about companies, and how to approach thinking about your career like picking a stock.

Thank you to Professor Sialm for the opportunity, and thank you to the students, our future leaders in business and finance!

Lukasz Tomicki believes that inflation will revert back to its 2% historical norm by 2023. He’s investing in sectors that have priced in a recession and stocks punished by inflation fears. Tomicki shared 11 stocks to buy for gains from both categories.

Texan value hedge fund headed for positive returns this years

The LRT Economic Moat, a portfolio of high-quality companies, has been shining so far this year and displaying a favourable approach to investing in today’s equity markets.

Lukasz Tomicki of LRT Capital Management likes healthcare stocks and shares of Russian natural gas companies as the crucial election year 2020 gets underway — an election he expects will culminate with President Donald Trump winning a second term.

Tomicki, who started Austin, Tex.-based hedge fund in 2012, joined the Contrarian Investor Podcast last month to discuss these and other ideas.

Matthias Knab from Opalesque TV recently interviewed LRT Capital founder, Lukasz Tomicki. In the video they discuss the history of the firm, The Economic Moat investment strategy, and why risk management is the most important part of any investment process.

HOBOKEN, N.J., Oct. 7, 2019 /PRNewswire/ — Context Summits, the preeminent producer of investment summits for the alternative asset management industry, today announced the winners of their first annual awards program, the Context 365 Awards.

EisnerAmper’s Trends Watch is a weekly entry to our Alternative Investments Intelligence blog, featuring the views and insights of executives from alternative investment firms. This week, Elana talks with Lukasz R. Tomicki, President, LRT Capital Management.

Tomicki, born in Warsaw, Poland, immigrated to the US as a child, attending high school in Missouri. It was here his entrepreneurial spirit and eye for opportunity was on display started a software company, LobbyAssist, that tracked legislation and campaign finance at the state level. He and his high school buddy partner teamed up with a Midwest lobbyist, patented the process, and scaled the software to cover 50 states in four years.